What is an Opt Out?

What is an Opt Out?

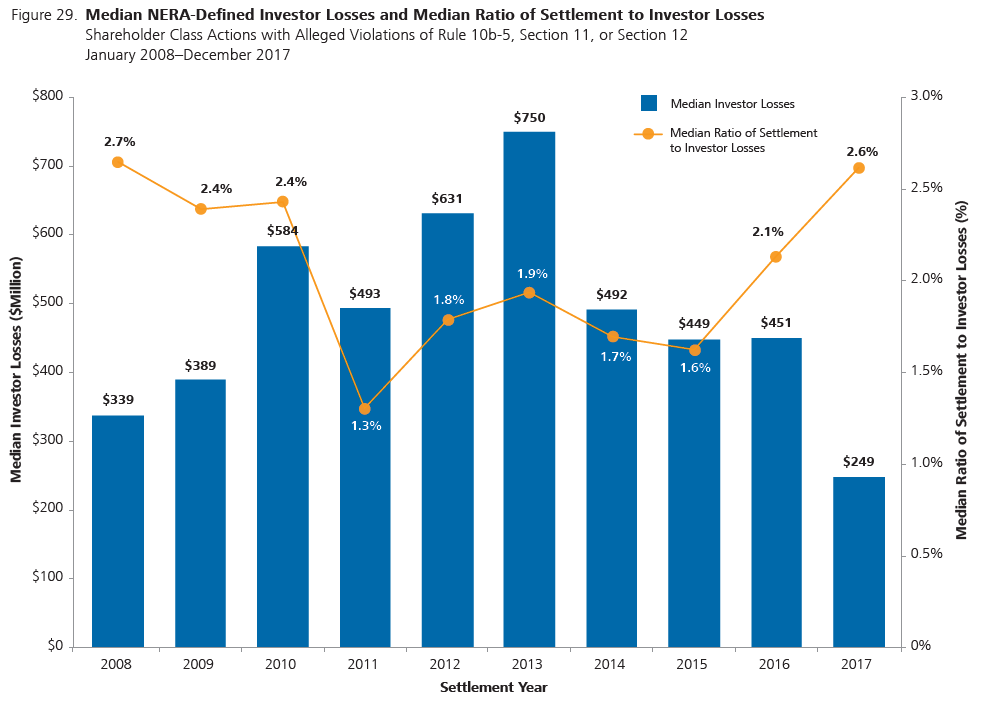

Opt out actions are lawsuits initiated by investors who decide not to proceed as members of class actions. Opt out actions allow investors to allege individual securities claims to recover losses caused by fraud or similar misconduct. Opt out litigation is a relatively new phenomenon that provides an alternative to de minimis class action recoveries. As documented here, class actions typically settle for 2%-3% of investors' losses. Opt out cases, on the other hand, have regularly settled for between 20% and 40+% of damages.

Opt out litigation is best understood in contrast to securities fraud class actions. The class action is the predominant means by which the vast majority of defrauded investors exercise their legal rights to reclaim investment losses. Securities class actions assert claims on behalf of a wide array of damaged investors and offer class members a pro rata share of any eventual recovery. Most class members have no direct interaction with the attorneys representing the class and have no say in negotiating the amount for which the class case settles. Opt out litigants control their own cases, interact with their attorneys to assure their interests are best represented, and directly determine whether to accept or reject settlement offers.

Securities class actions are limited to certain legal claims under the federal securities laws. Opt out litigants may have the option to pursue claims under state law as well as additional federal legal claims not available on a class-wide basis.

Damages in securities class actions oftentimes amount to billions of dollars, regularly exceeding the defendants' ability to pay. In opt out cases, the plaintiff's claims are typically between several million dollars and several hundred million dollars and, therefore, more likely within the range of judgments defendants can pay.

While opt out cases are an attractive alternative to securities class actions, there are many reasons investors may want to remain a member of the class in particular cases. Dietrich Siben Thorpe LLP provides investors a free consultation to assist in determining whether opting out of a particular class action is in the investor's best interests.

Why Individual Actions?

Why Individual Actions?

Securities fraud costs investors billions of dollars every year, destroying wealth by undermining the efficient flow of capital from willing investors to worthy businesses. Despite a proliferation of class action litigation, and the reward of billions of dollars in attorneys' fees to the class action plaintiffs bar, securities fraud has grown seemingly unabated and investors have seen little in the way of meaningful compensation for their losses. At Dietrich Siben Thorpe LLP, we believe that individual securities actions, under the right circumstances, provide the best means by which our clients can combat securities fraud and achieve meaningful recoveries of investment losses. The empirical evidence and our own experience prove the point.

Please click on the links below to learn more about each area.

Institutional investors already know from experience: securities class actions rarely obtain meaningful recoveries for investors. Securities class actions typically settle for between 2-3% of investors' losses.

"Mega-fraud" cases with massive investor losses typically settle for even less than the median. Recoveries of between two to three pennies-on-the-dollar are the norm in relatively small cases, but as investors' damages increase recoveries decline.

It's not that securities class actions are without merit. Rather, in our opinion, the class action mechanism suffers from inherent flaws preventing substantial recoveries in most cases. Once removed from the shackles of class action litigation, securities fraud victims in individual actions are oftentimes capable of obtaining substantial recoveries. DST's founders have been at the forefront of individual securities actions and are dedicated to maximizing our clients' recoveries outside the class action mechanism.

The empirical data overwhelmingly demonstrates that institutional investors that opt out of securities class actions have successfully recovered multiples over what they would have received had they remained members of the class case. As John C. Coffee, Jr., the Adolf A. Berle Professor of Law at Columbia University Law School, has found: "Institutional investors have seen that large recoveries are possible in individual suits and are now prepared to sue. . . . When institutional investors exit the class and sue individually, they appear to do dramatically better - by an order of magnitude!" Accountability and Competition in Securities Class Actions: Why "Exit" Works Better Than "Voice", 30:2 Cardozo L. Rev. 407 (2008).

Most of what is publicly known about opt out settlements is the result of public pension fund disclosures - hedge fund and mutual fund settlements are typically confidential. The available data is quite compelling. The Retirement Systems of Alabama recovered $49 million of its $57 million Enron loss by suing several of Enron's banks under Alabama state law. Several Ohio public pension funds recovered 36% of their AOL/Time Warner losses, settling for $175 million ($144 million after fees) or about 16 times more than the $9 million the funds would have recovered in the class settlement. Five New York City pension funds settled their WorldCom claims for $78.9 million - about 61% of their damages. Michael Cardozo, the New York City funds' corporate counsel, said in a statement: "This settlement fully validates the decision of the funds' trustees to opt out of the class action to pursue an individual case."

The following chart summarizes some of the more significant opt out settlements announced by public funds

| Fund & Case | Opt-Out Settlement (Millions) | Estimated Class Recovery | Opt-Out Recovery Multiple |

|---|---|---|---|

| Alaska Funds AOL/Time Warner | $50 | $1 | 50x |

| Alaska Funds Qwest | $19.0 | $0.4 | 44.5x |

| Texas Teachers Qwest | $61.6 | $1.4 | 44.0x |

| Colorado Pub. Empl. Ret. Assoc. Qwest | $15.5 | $0.4 | 38.8x |

| CalSTRS Qwest | $46.5 | $1.6 | 30x |

| New Jersey Tyco | $73.25 | $4.2 | 17x |

| U.C. Regents AOL/Time Warner | $246 | $14.5 | 16-24x |

The empirical data clearly demonstrates that settlements in individual securities fraud actions can be quite substantial. By contrast, as Ohio's attorney general explained in justifying Ohio's decision to pursue an individual action rather than remaining in the class case against AOL TimeWarner: "The class-action lawsuit, you get peanuts at the end of it . . . . The only guys who make money are the lawyers."

Our founders are uniquely experienced in the prosecution of individual securities fraud opt out actions. Our founders have litigated opt out cases to recover investors' losses in AOL/Time Warner, Tyco, Qwest and WorldCom, among many others, and are extremely knowledgeable about the facts and circumstances of the above referenced cases. We understand the factors that enable opt out litigants to successfully recover significantly more of their investment losses as compared to participants in securities class actions, and we look to this experience in counseling our clients.

Time is money. Unfortunately for participants in securities class actions, distributions of settlement proceeds oftentimes take between one and two years. Why? Upon settlement of a securities class action, the court grants preliminary approval, notice is sent to all class members who are given an opportunity to object to the settlement before final approval by the court can be granted. After the court issues a final approval of the settlement, class members are given a period in which to fill out claim forms that are filed with the claims administrator. The forms must then be processed by the claims administrator to assure there are no fraudulent or incorrect applications. Only after the numerous claims forms are submitted and reviewed can settlement proceeds begin to be distributed.

Once a settlement is reached in an opt out case, the plaintiff is typically paid in a few weeks. There is no arduous claims administration process or requirement for court approval. As a result, investors who file individual actions oftentimes are able to obtain significantly larger recoveries of their investment losses, and they regularly recover their losses faster than do class members.

Some of the most prestigious names in the investment community have recognized the merits of bringing individual securities fraud actions to recover their investment losses. While numerous public pension funds, including CalPERS, the Teacher Retirement System of Texas, and New York State Teachers, have publicly reported achieving excellent results through filing opt out cases, many well-regarded mutual funds and hedge funds have quietly achieved the same results. Many of these funds prefer to avoid publicity of their legal claims, which we respect. These hedge funds and institutional investors have discovered that bringing an individual action to recover investment losses is not only superior to participating in the class action settlement, but a beneficial utilization of the fund's resources and in the best interests of the fund's fiduciaries. Indeed, some funds have brought more than one individual action. If you are considering filing an opt out action and are interested in the names of other funds that have done so, we can provide you with this information upon request.

There are several reasons institutional investors have recovered more by opting out of securities class actions than they would have received had they remained in the class. Professor John C. Coffee, Jr. of Columbia University Law School sets forth a litany of factors supporting individual case recoveries in his excellent article Accountability and Competition in Securities Class Actions: Why "Exit" Works Better Than "Voice", 30:2 Cardozo L. Rev. 407 (2008). While we agree with Professor Coffee's work, we also have our own theories on the matter. See Recovering Investment Losses, The Investment Community Routinely Complains About Class Action Securities Fraud Settlements, But What Is A Hedge Fund Manager To Do About It? (2009) Knowing why individual securities fraud cases have done better than their related securities class actions is our stock-in-trade. At DST, we know what drives securities class actions and how to spot securities fraud cases that will translate well into individual actions. From this unique vantage point we then turn to the facts of each individual investor's case because we recognize that what might be right for some other fund may not be right for your fund.

Securities fraud class actions rarely obtain meaningful recoveries for investors, but that does not mean institutional investors should reflexively file individual cases to maximize the recovery of their investment losses. There are instances when remaining in the class action makes sense. Indeed, we oftentimes advise funds to remain in a class action for reasons not readily apparent to lawyers unfamiliar with opt out litigation. At DST, we have unparalleled experience litigating both securities class actions and individual securities fraud cases, and we welcome the opportunity to guide your fund in analyzing whether an individual case is right for you. We are happy to investigate potential claims for your fund, free of charge. We work on a contingency fee basis, and are paid only by what we can recover of your investment loss. Accordingly, we are selective in the cases we bring and we will only recommend filing suit if we believe your claim has substantial merit and is highly likely to provide a meaningful recovery for your fund.

Case Samples

Case Samples

Please click on the company name below to view full case study.

DST recently represented a prominent investment advisor with over $9 billion in assets under management in an opt out action against Comverse, and certain of its former officers and directors. The case was successfully resolved for a significant premium over the recovery in the securities class action.

The action, brought in New York federal court, alleged both federal securities law violations and state law negligent misrepresentation claims, unavailable to plaintiffs in the class action.

As alleged in our complaint, and revealed through a series of civil and criminal investigations and criminal guilty pleas, Comverse's former Chief Executive Officer, Jacob "Kobi" Alexander, and former Chief Financial Officer, purposefully manipulated the Company's reported financial statements by adjusting quarter-end reserve accounts to create desired earnings per share and moving expenses from one category to another as a way of ensuring that the Company's expenses would appear to grow in a measured and consistent manner. Further, Plaintiffs alleged Alexander directed the CFO to manipulate the sales backlog figure that the Company reported in its annual reports in order to report numbers consistent with what Alexander believed Wall Street investors would view favorably.

While Comverse's former CEO and CFO were allegedly cooking the books to report manipulated financial results to investors, Defendants were also deliberately backdating Comverse's stock options grants to lavishly reward Comverse's former senior officers with in-the-money stock options despite Comverse's repeated assurances to the market to the contrary. In April 2006, the Company disclosed that as a result of the irregularities relating to accounting for the Company's stock option grants, it would be required to restate financial results for fiscal years 2001 through 2005, as well as the first three quarters of fiscal year 2006. In July 2006, as a result of their role in this scheme, Comverse's CEO, CFO and General Counsel were indicted by a federal grand jury, and were also charged by the SEC with civil fraud. The Company's former CFO and General Counsel pleaded guilty to the criminal charges shortly thereafter. Alexander, the former CEO, fled the country to Namibia.

Plaintiffs’ opt out action was an overwhelming success. Plaintiffs obtained a significant premium over their potential recovery in the Comverse class action. Plaintiffs settled the opt out for cash; no portion of the settlement was made in stock, as was the case in the class action. And, Plaintiffs were able to resolve their opt out action contemporaneously with the payout in the class case. DST is proud of the achieved result, and of the representation it provided in this significant matter.

DST successfully represented several mutual funds in an individual securities action that settled for a substantial recovery of the funds’ losses when they stood to receive nothing in the class action.

The mutual funds prosecuted an individual securities action against Washington Mutual’s former officers and directors, as well as several prominent Wall Street banks. Our clients alleged the defendants made materially false and misleading statements in connection with the offerings of unregistered, Rule 144A Washington Mutual Preferred Funding Trust securities issued on March 7, 2006 and October 25, 2007. According to the complaint, defendants misleadingly represented critical elements of Washington Mutual’s business practices and financial condition, which had a material impact upon Washington Mutual’s creditworthiness and the suitability of any investment in the Preferred Trust Securities. Among other things, Washington Mutual claimed to have adhered to prudent underwriting standards, utilized independent appraisals, encouraged proactive risk management, and maintained effective internal controls.

In truth, as alleged in the complaint, Washington Mutual had secretly abandoned its purportedly prudent underwriting standards and was fraudulently inflating appraisals in order to artificially inflate loan volumes and publicly reported earnings. According to the accounts of numerous witnesses, summarized in The New York Times: "At WaMu, getting the job done meant lending money to nearly anyone who asked for it . . . ." As one former appraiser for Washington Mutual recounted: "If you were alive, they would give you a loan. Actually, I think if you were dead, they would still give you a loan."

Washington Mutual's true financial condition and business practices began to come to light only days after the 2007 offering. On November 1, New York Attorney General Andrew Cuomo revealed Washington Mutual orchestrated a systemic fraud to illegally inflate appraisals used in its loan origination process.

By December 2007, the SEC launched an inquiry into Washington Mutual's public disclosures concerning its lending practices and its accounting for loans. The SEC investigation was followed up by a criminal investigation, in which a grand jury was convened.

By April 2008, Goldman, Sachs & Co.'s analyst recommended investors short Washington Mutual stock as the bank had as much as $23 billion in bad loans that it had not yet accounted for. In effect, Washington Mutual was insolvent.

On September 25, 2008, the Federal Deposit Insurance Corporation took control of Washington Mutual. According to Lawrence J. White, professor of economics at the NYU Stern School of Business: "As had been feared, WaMu really did hold a slew of poorly performing mortgages whose nominal value greatly exceeded their market value." Confirming that Washington Mutual had extended loans to borrowers with no ability to repay, upon purchasing Washington Mutual Bank from the FDIC the same day of its seizure, JP Morgan immediately marked down the value of Washington Mutual's loans by $31 billion.

The action was pending in Washington federal court, and alleged both federal and state securities law claims. Prior to settlement, the Court upheld our core allegations of fraud and negligent misrepresentation against all defendants.

Dietrich Siben Thorpe LLP represented a registered investment adviser with approximately $4 billion in assets under management, as well as several foundations, in an opt out action arising from the alleged securities fraud perpetrated by Countrywide Financial Corporation, certain of its former senior officers and directors, and Countrywide's former auditor, KPMG LLP.

As alleged in our Complaint, Countrywide and its executive management portrayed the Company as primarily a prime lender that was conservatively run. Defendants boasted Countrywide employed prudent underwriting guidelines and a robust underwriting process to ensure the origination of high credit quality loans to borrowers who could and would repay. This was not the case. Defendants knew, but concealed, substantial material information concerning Countrywide's true loan quality and loan production, that Countrywide had abandoned sound underwriting practices, and the risks associated with Countrywide's unsound lending practices.

The alleged fraud perpetrated by Angelo Mozilo, Countrywide's former Chief Executive Officer, David Sambol, Countrywide's former Chief Operating Officer, and Eric Sieracki, Countrywide's former Chief Financial Officer, has been the subject of significant public scrutiny and has been well-documented by the United States Securities and Exchange Commission.

According to the Securities and Exchange Commission's allegations, Mozilo, Sambol and Sieracki committed "securities fraud [by] deliberately misleading investors about the significant credit risks being taken in efforts to build and maintain the company's market share." For example, according to the SEC, internal Countrywide documents show "both Mozilo and Sambol were aware as early as June 2006 that a significant percentage of borrowers who were taking out stated income loans were engaged in mortgage fraud ... [but these] material facts were never disclosed to investors."

Despite allegedly concealing material information from investors from 2004 through 2007, Countrywide's senior executives dumped hundreds of millions of dollars of their personal Countrywide stock during the same time frame. Mozilo, Sambol and Sieracki sold over $550 million of Countrywide shares in 2004-2007.

The risks associated with Countrywide's undisclosed reckless lending strategy ultimately materialized, and the Company experienced extremely high rates of loan delinquencies and defaults. Countrywide collapsed under the weight of its toxic loan portfolio. A securities class action ensued. As set forth in the Countrywide class action complaint, "as a consequence of the revelation of the truth concerning Countrywide during the Class Period, Countrywide common stock lost in excess of $25 billion in market capitalization, or more than 90% of its value." Our clients, like many investors, suffered substantial losses due to the Defendants' alleged fraud.

A settlement in the Countrywide securities class action was first announced in May 2010, and finally approved in March 2011. Our clients opted out of the settlement, and in March 2011, Dietrich Siben Thorpe LLP filed this action on behalf of its clients in Federal Court in Los Angeles.

Prior to founding Dietrich Siben Thorpe LLP, Mr. Siben and Mr. Thorpe successfully litigated an opt out action on behalf of prominent mutual funds, hedge funds, and a public pension fund against Tyco International and its former CEO L. Dennis Kozlowski, CFO Mark H. Swartz, and Director Frank E. Walsh, Jr. Our clients settled with Tyco for $100 million, representing a significant multiple over what they would have received had they remained in the related securities class action.

We recognized Tyco to be a highly meritorious securities fraud action. The defendants' conduct had, as Fortune aptly put it, turned Tyco into "a notorious corporate rogue that in the public's mind ... rank[s] with Enron and WorldCom for murky accounting, corrupt leadership, and guile at conning investors."

Our involvement in the case began when, on May 15, 2007, Tyco and the plaintiffs in the class action against Tyco announced a settlement in which Tyco agreed to pay investors $2.975 billion. Mr. Siben and Mr. Thorpe estimated that investors collectively lost approximately $50 billion as a result of the Tyco accounting fraud. The class action settlement, even with a subsequent contribution by PricewaterhouseCoopers, represented a recovery of only about 6% of investors' losses - before deducting the class action attorneys' $493 million in fees and expenses.

Rather than accept the pennies-on-the-dollar recovery in the class action, our clients filed their own case in the District of New Jersey on November 29, 2007. On behalf of our clients, Mr. Siben and Mr. Thorpe alleged negligence-based claims and violations of New Jersey's RICO statute - legal theories unavailable to the class action plaintiffs but which provided substantial benefits to the opt out litigants.

Our clients reached a resolution with Tyco to settle for $100 million in May 2009. Our clients were not subjected to any formal discovery and did not sit for any depositions. We were able to obtain this recovery despite an unprecedented market meltdown that generally limited all corporate capital expenditures, and without the benefit of any insurance contribution to the recovery. Our clients received their settlement proceeds within weeks of finalizing the settlement, whereas members of the class action did not begin to receive distributions until after March 4, 2009, almost two years after the class action settlement was first announced.

Please click here to see a press release issued by the Office for the Attorney General for the State of New Jersey, which was represented by different lawyers, announcing its settlement with Tyco.

Before co-founding DST, Mr. Thorpe represented the University of California pension and endowment funds, Amalgamated Bank's LongView Collective Investment Fund, and several Ohio state pension funds in a series of individual securities actions against AOL Time Warner, its officers and directors, and the company's auditor, Ernst & Young LLP. Mr. Thorpe's clients collectively resolved their actions against AOL Time Warner for $435 million. The University of California alone recovered $246 million - the single largest reported opt out settlement at the time.

The AOL Time Warner actions represented one of the first large-scale opt out efforts by institutional investors to recover losses caused by alleged securities fraud. In 2003, Mr. Thorpe's clients filed actions in both California and Ohio state courts, prior to any class action settlement. In this unique "early" opt out approach, Mr. Thorpe's clients took advantage of broad-based state securities laws and proceeded with their actions in local state courts.

The suits alleged that before and after AOL's merger with Time Warner in January 2001, top executives at AOL used falsified revenue transactions to inflate the value of AOL stock to help secure a merger with Time Warner while liquidating their shares to enrich themselves to the tune of $936 million. The scheme began in the period leading up to the merger when AOL executives allegedly falsified e-commerce advertising business that pumped up AOL stock prices. As alleged, the advertising deals included swaps with other internet companies that AOL misleadingly counted as revenues or transactions involving AOL's own funds that were provided to purported customers. Many of the deals were also made with companies that lacked the financial wherewithal to honor them.

The merger was called "a terrible deal" by Dow Jones, the "worst deal of the century" by Time and "one of the great train wrecks in corporate history" by Fortune. The New York Times noted that AOL executives "pulled off one of the sweetest deals in business history . . . by managing to acquire Time Warner with AOL's inflated stock." Richard Parsons, AOL Time Warner's former CEO called the merger "silly" and a "mistake" based on "overly ambitious" forecasts that were "not real." Due to overvalued assets, the merged company took a $100 billion loss in 2002.

In the subsequent five months after the merger, company executives sold off 10.7 million shares from personal portfolios. During the same period, however, the company spent $1.3 billion to repurchase 30.2 million shares on the open market - in effect, using corporate money to prop up the stock's value so they could benefit personally and shield themselves from a stock collapse. AOL Time Warner's stock price ultimately plummeted from a high of $58.51 per share to a low of $8.60 per share, resulting in the loss of more than $200 billion in shareholder value.

In December 2004, the company reached monetary settlements with the Securities and Exchange Commission (the "SEC") and the Department of Justice (the "DOJ") in connection with allegations of fraud and accounting manipulations before and at the time of the merger. AOL Time Warner agreed to pay a $60 million fine to the DOJ and establish a $150 million fund for securities settlements, as well as pay a $300 million fine to the SEC and retain an independent examiner to review certain historic revenue transactions between 1999 and 2002.

In September 2005, AOL Time Warner reached a $2.65 billion settlement with investors in the class action, which included the $150 million secured as part of its DOJ settlement, as well as an additional $100 million contributed by Ernst & Young. The class action settlement represented less than 1.5% of investors' total losses.

In contrast, Mr. Thorpe's clients settled their actions in early 2007, and received settlement proceeds shortly thereafter. By opting out and pursuing an individual action, the University of California received between 16 and 24 times more than its estimated pro rata recovery in the class action.

Please click here to see a press release issued by the University of California Office of the President, announcing its settlement with AOL Time Warner.

Prior to founding DST, Mr. Siben and Mr. Thorpe represented several investment companies in an opt out action against the former CEO and CFO of Qwest Communications International, Inc., Joseph Nacchio and Robert Woodruff.

The case against Nacchio and Woodruff was particularly strong. According to the SEC's civil complaint filed on March 15, 2005, from at least April 1, 1999 through March 1, 2002, Qwest and its senior officers, including Nacchio and Woodruff, "engaged in a massive financial fraud that hid from the investing public the true source of the company's revenue and earnings growth." The SEC stated in a press release, the "disclosure fraud at Qwest was orchestrated at the highest level of the company to deceive investors" and defendants, including Nacchio and Woodruff, "projected revenue and earnings that they knew were overly aggressive, and then . . . used smoke and mirrors to meet those unrealistic projections." Furthermore, on April 19, 2007, after a 15 day trial, a federal jury found Nacchio guilty of 19 counts of illegal insider stock sales. According to federal prosecutors, Nacchio's financial shenanigans turned Qwest into a "house of cards" and Nacchio cashed out after "deciding not to tell investors [Qwest] was about to come crashing down."

In 2005, the class action plaintiffs settled with Qwest and certain of its senior officers and directors (not including Nacchio and Woodruff) for $400 million. Investors' losses in Qwest securities were massive by any measure. The Company's market capitalization dropped by over $90 billion, Qwest shares dropped from a high of $64 to only $1.11 per share in August 2002.

A number of investors opted out of the $400 million class action settlement with Qwest. According to the Company, the opt out plaintiffs settled their claims for an aggregate $411 million - more than the class action settlement. According to available data released by certain public funds, the opt out plaintiffs recovered far more than what they would have received by remaining as passive members of the class action:

| Qwest Opt-Outs | Recovery In Opt-Out Settlement (Millions) | Estimated Class Recovery (Millions) | Opt-Out Recovery Multiple |

|---|---|---|---|

| State of Alaska Funds | $19.0 | $0.4 | 44.5x |

| Teachers Retirement System of Texas | $61.6 | $1.4 | 44.0x |

| Colorado Public Employees' Ret. Assoc. | $15.5 | $0.4 | 38.8x |

| CalSTRS | $46.5 | $1.6 | 30x |

In August 2008, the class action plaintiffs announced a $45 million settlement with Nacchio and Woodruff. This $45 million settlement amounted to an average recovery of only $0.0115 per damaged Qwest share - before deductions for requested attorneys' fees and expenses. Mr. Siben and Mr. Thorpe recognized that class members could opt out of the $45 million settlement to pursue a full recovery against Nacchio and Woodruff, without relinquishing their right to a recovery from the $400 million class action settlement or the $252 million settlement that Qwest reached with the SEC.

In January 2009, Mr. Siben and Mr. Thorpe, while with their former law firm, filed an opt out proceeding on behalf of several investment companies against Nacchio and Woodruff, seeking to hold these defendants jointly and severally liable for the entirety of the plaintiffs' damages. This case has been resolved on a confidential basis.

Please click here to see a press release issued by The Teacher Retirement System of Texas, which was not represented by DST, detailing Texas Teachers' successful opt out experience.